COBS 19.1 Pension transfers, conversions, and opt-outs5

Application

[deleted]7

7This section applies to a firm which gives advice on pension transfers, pension conversions and pension opt-outs to a retail client in relation to:

- (1)

a pension transfer from a scheme with safeguarded benefits;

- (2)

a pension conversion; or

- (3)

a pension opt-out from a scheme with safeguarded benefits or potential safeguarded benefits.

7A firm should comply with this section in order to give appropriate independent advice for the purposes of section 48 of the Pension Schemes Act 2015.

Definitions

7In this section and in COBS 19 Annex 4A, 4B and 4C:

- (a)

“appropriate pension transfer analysis” refers to the analysis prepared in accordance with COBS 19.1.2BR;

- (b)

“ceding arrangement” refers to the retail client’s existing pension arrangement with safeguarded benefits;

- (c)

“future income benefits” refers to the full value of the pension income that would have been paid by the ceding arrangement (that is, before any commutation for a lump sum);

- (d)

“proposed arrangement” refers to the arrangement with flexible benefits to which the retail client would move and takes into account the subsequent intended pattern of decumulation;

- (e)

“transfer value comparator” refers to a comparison prepared in accordance with COBS 19.1.3AR.

Requirement for pension transfer specialist

- (1)

7A firm must ensure that advice on pension transfers, pension conversions and pension opt-outs is given or checked by a pension transfer specialist.

- (2)

The requirement in (1) does not apply where the only safeguarded benefit involved is a guaranteed annuity rate.

Role of the pension transfer specialist when checking

7When a firm uses a pension transfer specialist to check its proposed advice on pension transfers, pension conversions and pension opt-outs, it should ensure that the pension transfer specialist takes the following steps:

- (1)

checks the entirety and completeness of the advice;

- (2)

confirms that any personal recommendation is suitable for the retail client in accordance with the obligations in COBS 9.2.1R to 9.2.3R and including those matters set out at COBS 19.1.6G; and

- (3)

confirms in writing that they agree with the proposed advice before it is provided to the retail client, including any personal recommendation.

Personal recommendation for pension transfers and conversions

- (1)

7A firm must make a personal recommendation when it provides advice on conversion or transfer of pension benefits.

- (2)

Before making the personal recommendation the firm must:

- (a)

determine the proposed arrangement with flexible benefits to which the retail client would move; and

- (b)

carry out the appropriate pension transfer analysis and produce the transfer value comparator7.

- (a)

- (3)

The requirement in (2)(b) does not apply if the only safeguarded benefit involved is a guaranteed annuity rate7.

- (4)

The firm must take reasonable steps to ensure that the retail client understands how the key outcomes from the appropriate pension transfer analysis and the transfer value comparator contribute towards the personal recommendation.7

7 COBS 9 contains suitability requirements which apply if a firm makes a personal recommendation in relation to advice on conversion or transfer of pension benefits.

Appropriate pension transfer analysis

7To prepare an appropriate transfer analysis a firm must:

- (1)

assess the benefits likely to be paid and options available under the ceding arrangement;

- (2)

compare (1) with those benefits and options available under the proposed arrangement; and

- (3)

undertake the analysis in (1) and (2) in accordance with COBS 19 Annex 4A and COBS 19 Annex 4C.

7 COBS 19.1.1-AR and COBS 19.1.2BR do not preclude a firm from preparing other forms of the analysis (for example, stochastic cashflow modelling) which are relevant to making a personal recommendation to the retail client, as long as projected outcomes at the 50th percentile are no less conservative than if the analysis had been prepared in accordance with COBS 19 Annex 4A and COBS 19 Annex 4C.

- (1)

7This guidance applies if a firm presents information in the appropriate pension transfer analysis which considers the impact of:

- (a)

the Pension Protection Fund and the FSCS; or

- (b)

scheme funding or employer covenants.

- (a)

- (2)

If a firm presents the information in (1) it should, in accordance with Principle 7 and the fair, clear and not misleading rule, do so in a way that is balanced and objective.

- (3)

If a firm does not have specialist knowledge in assessing the impact of (1)(a) or 1(b), it should consider not including the information.

- (1)

7This guidance applies if a firm presents information in the appropriate pension transfer analysis:

- (a)

that contains an indication of future performance; and

- (b)

is produced by a financial planning tool or cash flow model that uses different assumptions to those shown in the key features illustration for the proposed arrangement.

- (a)

- (2)

A firm presenting the information in (1) should explain to the retail client why different assumptions produce different illustrative financial outcomes.

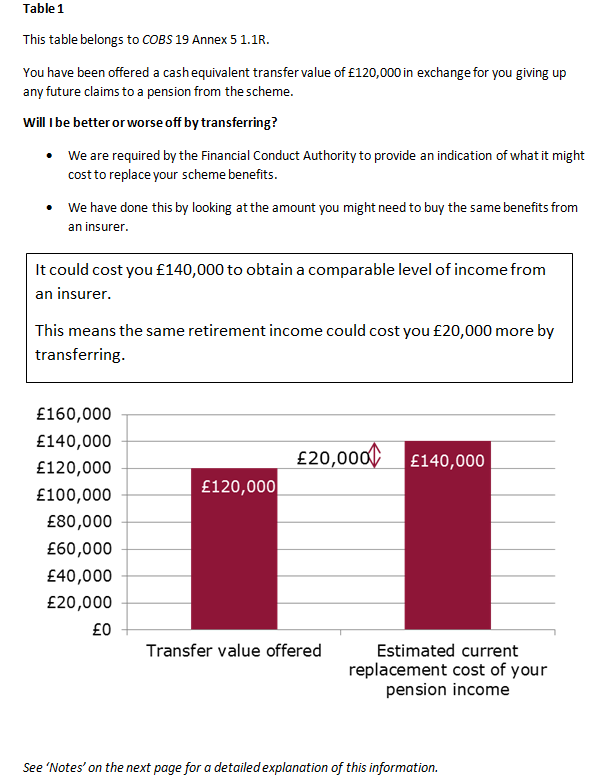

Transfer value comparator

- (1)

7To prepare a transfer value comparator, a firm must compare the transfer value offered by the ceding arrangement with the estimated value needed today to purchase the future income benefits available under the ceding arrangement using a pension annuity (calculated in accordance with COBS 19 Annex 4B and COBS 19 Annex 4C).

- (2)

The firm must provide the transfer value comparator to the retail client in a durable medium using the format and wording in COBS 19 Annex 5 and:

- (a)

where the retail client has 12 months or more before reaching normal retirement age, use the notes set out at COBS 19 Annex 5 1.2R; or

- (b)

where the retail client has less than 12 months before reaching normal retirement age, use the notes set out at COBS 19 Annex 5 1.3R.

- (a)

Guidance on assessing suitability

-

(1)

The guidance in this section relates to the obligations to assess suitability in COBS 9.2.1R to 9.2.3R.7

-

(2)

When a firm is making a personal recommendation for a retail client who is, or is eligible to be, a member of a pension scheme with safeguarded benefits and who is considering whether to transfer, convert or opt-out, a firm should start by assuming that a transfer, conversion or opt-out will not be suitable.7

-

(3)

A firm should only consider a transfer, conversion or opt-out to be suitable if it can clearly demonstrate, on contemporary evidence, that the transfer, conversion or opt-out is in the retail client’s best interests.7

-

(4)

To demonstrate (3), the factors a firm should take into account include:7

- (a)

the retail client’s intentions for accessing pension benefits;7

- (b)

the retail client’s attitude to, and understanding of the risk of giving up safeguarded benefits (or potential safeguarded benefits) for flexible benefits, taking into account the following factors:9

7- (i)

9the risks and benefits of staying in the ceding arrangement;

- (ii)

9the risks and benefits of transferring into an arrangement with flexible benefits;

- (iii)

9the retail client’s attitude to certainty of income in retirement;

- (iv)

9whether the retail client would be likely to access funds in an arrangement with flexible benefits in an unplanned way;

- (v)

9the likely impact of (iv) on the sustainability of the funds over time;

- (vi)

9the retail client’s attitude to and experience of managing investments or paying for advice on investments so long as the funds last; and

- (vii)

9the retail client’s attitude to any restrictions on their ability to access funds in the ceding arrangement;

- (i)

- (c)

the retail client’s attitude to, and understanding of investment risk;7

- (d)

the retail client’s realistic retirement income needs including:7

- (i)

how they can be achieved; 7

- (ii)

the role played by safeguarded benefits (or potential safeguarded benefits) in achieving them; and 7

- (iii)

the consequent impact on those needs of a transfer, conversion or opt-out, including any trade-offs; and7

- (i)

- (e)

alternative ways to achieve the retail client’s objectives instead of the transfer, conversion or opt-out.7

- (a)

- (5)

9If a firm uses a risk profiling tool or software to assess a retail client’s attitude to the risk in (4)(b) it should:

- (6)

9When a firm asks questions about a retail client’s attitude to the risk in 4(b) it should consider the rules on communicating with clients (COBS 4), which require a firm to ensure that a communication is fair, clear and not misleading.

Working with another adviser

- (1)

9This guidance relates to the obligations to assess suitability in COBS 9.2.1R to 9.2.3R.

- (2)

Paragraphs (3) and (4) apply in the following situations:

- (a)

where two or more firms are involved in providing both advice on pension transfers, pension conversions and pension opt-outs and advice on investments in relation to the same transaction; and

- (b)

where two or more employees within the same firm are involved in providing both advice on pension transfers, pension conversions and pension opt-outs and advice on investments in relation to the same transaction.

- (a)

- (3)

In such situations, firms should work together (or ensure their employees work together) to:

- (a)

obtain information from the retail client under COBS 9.2.2R(1) that is sufficient to inform both the advice on pension transfers, pension conversions and pension opt-outs and the advice on investments; and

- (b)

obtain information from the retail client under COBS 9.2.2R(2) about the client’s preferences regarding risk taking and their risk profile that covers both the risk in COBS 19.1.6R(4)(b) and the risk in COBS 19.1.6R(4)(c).

- (a)

- (4)

In such situations, the firm(s) providing the advice on investments in relation to the proposed transaction should ensure that (where relevant) the advice takes into account the impact of any loss of safeguarded benefits (or potentially safeguarded benefits) on the retail client’s ability to take on investment risk.

Record keeping and suitability reports

7If a firm arranges a pension transfer or pension opt-out for a retail client without making a personal recommendation it must:

-

(1)

make a clear record of the fact that no personal recommendation was given to that client; and

-

(2)

retain this record indefinitely.

If a firm provides a suitability report to a retail client in accordance with COBS 9.4.1R7 it should include:

-

(1)

a summary of the advantages and disadvantages of its personal recommendation;

-

(2)

an analysis of the financial implications (if the recommendation is to opt-out); 7

-

(2A)

a summary of the key outcomes from the appropriate pension transfer analysis (if the recommendation is to transfer or convert); and7

-

(3)

a summary of any other material information.

If a firm proposes to advise a retail client not to proceed with a9pension opt-out, it should give that advice in writing.

5The statutory advice requirement

- (1)

9Where a firm has advised a retail client in relation to a pension transfer or pension conversion and the firm is asked to confirm this for the purposes of section 48 of the Pension Schemes Act 2015, then the firm should provide such confirmation as soon as reasonably practicable.

- (2)

9The firm should provide the confirmation regardless of whether it advised the client to proceed with a pension transfer or pension conversion or not.

Triage services

9The table in PERG 12 Annex 1G includes examples of when a firm is and is not advising on conversion or transfer of pension benefits when it has an initial “triage” conversation with a potential customer. The purpose of triage is to give the customer sufficient information about safeguarded benefits and flexible benefits to enable them to make a decision about whether to take advice on conversion or transfer of pension benefits.